Financial Assistant: Your Partner in Building a Secure Future

Financial Assistant: Your Partner in Building a Secure Future

Blog Article

Find the Perfect Finance Solutions to Meet Your Financial Objectives

In today's complicated financial landscape, the quest to locate the perfect funding services that align with your one-of-a-kind monetary goals can be a difficult task. With countless choices available, it is critical to browse via this labyrinth with a strategic strategy that ensures you make educated decisions (Loan Service). From comprehending your financial demands to assessing lending institution track record, each step in this procedure needs mindful consideration to safeguard the finest feasible outcome. By adhering to a methodical strategy and weighing all factors at play, you can place on your own for monetary success.

Analyzing Your Financial Needs

When considering finance solutions for your economic goals, the initial action is to extensively evaluate your current economic requirements. Begin by assessing the specific function for which you need the loan.

In addition, it is crucial to carry out a detailed evaluation of your present monetary circumstance. Take into consideration aspects such as your debt rating, existing financial obligations, and any upcoming expenses that might affect your ability to repay the lending.

Along with understanding your economic demands, it is recommended to research and contrast the finance choices available in the market. Various finances included differing terms, passion prices, and repayment timetables. By very carefully assessing your needs, monetary placement, and offered lending items, you can make an educated choice that supports your economic goals.

Recognizing Funding Options

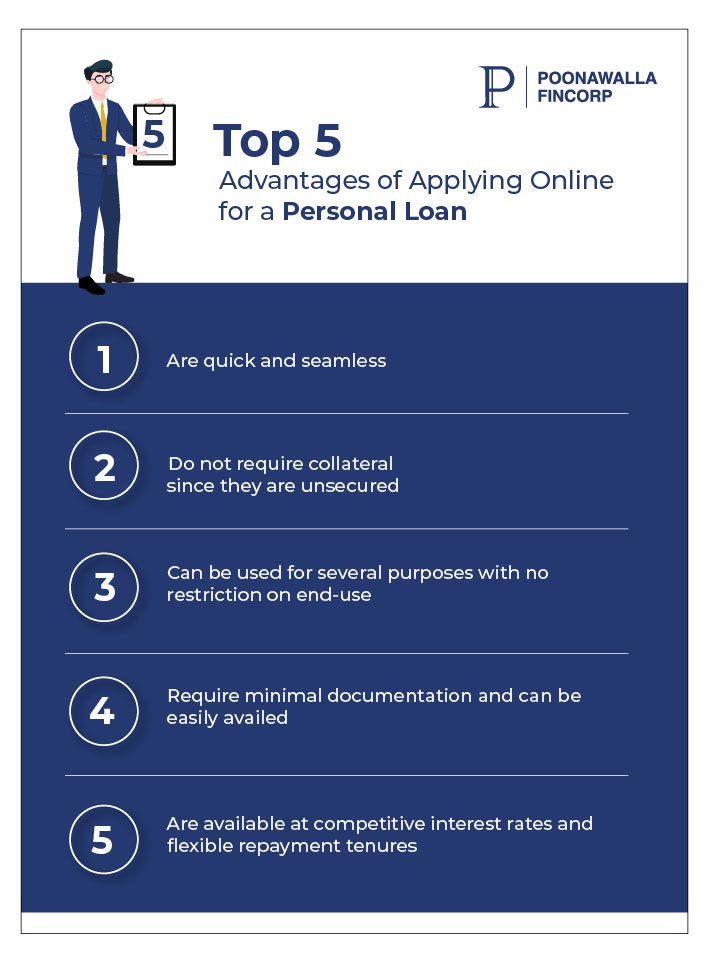

Checking out the selection of funding alternatives offered in the economic market is important for making educated decisions lined up with your details needs and objectives. Recognizing lending options involves familiarizing yourself with the various sorts of financings offered by financial institutions. These can range from traditional alternatives like individual financings, home mortgages, and vehicle finances to more specialized products such as home equity fundings, payday advance, and trainee finances.

Each kind of loan comes with its own terms, conditions, and repayment structures (merchant cash advance direct lenders). Individual fundings, as an example, are unprotected finances that can be made use of for different objectives, while home loans are safeguarded fundings specifically created for purchasing actual estate. Auto finances accommodate funding lorry acquisitions, and home equity fundings allow homeowners to borrow versus the equity in their homes

Comparing Rate Of Interest and Terms

To make informed decisions pertaining to car loan choices, a vital action is comparing rate of interest prices and terms offered by monetary establishments. Rate of interest figure out the price of obtaining money, affecting the overall quantity repaid over the funding term. Reduced rates of interest mean lower general expenses, making it vital to seek the best rates offered. Terms refer to the conditions of the finance, consisting of the repayment period, fees, and any extra demands set by the loan provider. Comprehending and contrasting these terms can assist debtors select one of the most ideal financing for their monetary circumstance. When contrasting rate of interest, take into consideration whether they are dealt with or variable. Dealt with prices continue to be continuous throughout the finance term, giving predictability in settlement quantities. Variable rates, on the various other hand, can rise and fall based upon market problems, potentially affecting monthly settlements. In addition, examine the effect of funding terms on your monetary goals, ensuring that the picked finance lines up with your budget plan and long-term objectives. By meticulously examining rate of interest and terms, consumers can choose a finance that finest meets their demands while lessening costs and threats.

Evaluating Loan Provider Reputation

In addition, take into consideration contacting regulative bodies or financial authorities to ensure the lending institution is certified and compliant with sector laws. A credible lender will have a strong record of ethical lending techniques and clear interaction with borrowers. It is likewise helpful to look for recommendations from friends, family, or economic consultants who may have experience with credible lenders.

Eventually, choosing a lending institution with a solid online reputation can give you satisfaction and confidence in your borrowing choice (best merchant cash advance companies). By performing detailed study and due persistance, you can pick a lending institution that straightens with your economic objectives and worths, establishing you up for a successful borrowing experience

Selecting the most effective Financing for You

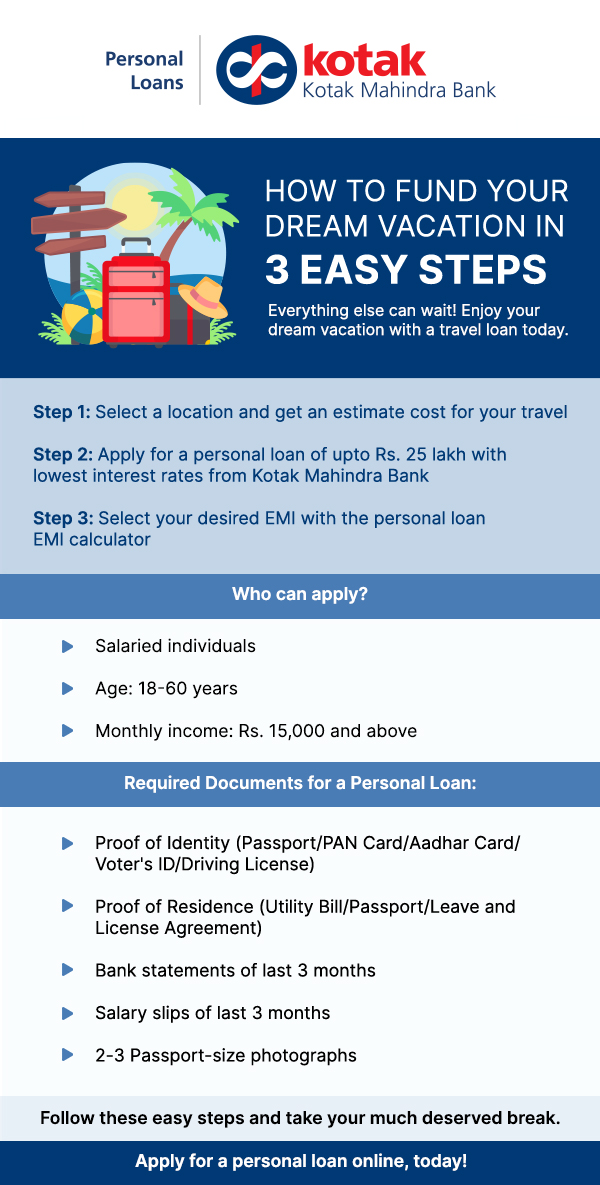

Having thoroughly evaluated a lender's reputation, the following critical action is to very carefully choose the finest funding choice that aligns with your financial objectives and requirements. When selecting a car loan, consider the purpose of the lending. Whether it's for buying a home, combining debt, moneying education and learning, or starting a business, various fundings cater to specific demands. Evaluate your financial scenario, including your earnings, expenses, credit report, and existing debts. Understanding your economic health will certainly assist determine the sort of car loan you receive and can conveniently repay.

Contrast the rate of interest, lending terms, and i loved this fees supplied by different loan providers. Reduced interest prices can save you money over the life of the financing, while positive terms can make settlement more manageable. Consider any type of added prices like source costs, early repayment penalties, or insurance coverage needs.

Additionally, take notice of the payment routine. Pick a lending with regular monthly repayments that fit your spending plan and duration for settlement. Flexibility in repayment options can also be beneficial in instance of unanticipated financial changes. Ultimately, select a car loan that not only satisfies your present monetary requirements however likewise supports your long-lasting financial goals.

Final Thought

Finally, finding the ideal finance services to meet your economic objectives needs an extensive assessment of your economic requirements, comprehending lending options, contrasting rates of interest and terms, and reviewing loan provider credibility. By carefully taking into consideration these factors, you can pick the very best lending for your specific circumstance. It is essential to prioritize your economic goals and choose a finance that lines up with your lasting monetary objectives.

Report this page